- Home

- Marketplace

- Company

Driving Success for Short-Term Lenders through Knowledge, Technology, and Partnership

Dive into a world of opportunities! Start an amazing new career today!

- Solutions

- Resources

Your hub for smarter, stronger lending resources

Our premier webinar series featuring the industry's Top Solution Providers

The industry’s premier event. Connect with trailblazers, collaborate with peers, and discover breakthrough solutions from the top providers in lending.

- Contact

LendSuite Software

Solutions Overview

At LendSuite, we unify powerful solutions that help short-term lenders grow smarter—from first lead to final payment. Explore how our industry-leading brands—Tekambi, EPIC Loan Systems and Infinity Software—work together to streamline every stage of the lending journey.

Tekambi empowers you to control lead flow and credit risk with real-time decisioning tools.

EPIC Loan Systems delivers trusted origination and servicing tools to manage your portfolio with precision.

Infinity Software combines it all in one intuitive platform built to scale with your business.

Whether you’re launching, growing, or optimizing your lending operation, LendSuite has the tech and expertise to support your success.

Learn About Our Lending Solutions

DECISION ENGINE

Tekambi is a credit risk underwriting solution that enables lending portfolios the power to control any aspect of the lead purchasing process.

The Smartest Way to Manage Lead Data

LOAN MANAGEMENT SYSTEM

Infinity’s powerful all-in-one platform makes it easy to process loans, grow your customer base, and scale your business. Whether you are lending to 50 people or 50 million, feel confident that you have the easiest to use, most powerful technology, backed by the best support in the industry.

LOAN MANAGEMENT SYSTEM

EPIC has years of expertise in the small dollar lending space. They help new and experienced lenders alike, offering powerful loan origination and servicing tools to monitor and analyze your portfolios. Consolidate your strategy without increasing overhead.

DECISION ENGINE

TEKAMBI

Learn more about our products and services

Founded by a team of experienced technical leaders, Tekambi transforms the way online lenders manage their lead campaigns and underwriting process.

Bridging the gap between technology and design, Tekambi’s underwriting and decisioning tool simplify the lead management process. Our goal is to streamline and solve pain points that lenders run into on a daily basis to help them improve customer conversions, communications, and the overall customer experience...

Hosted on the cloud with dynamic scaling, Tekambi provides a secure and efficient solution. With our team of senior developers and the latest development practices, we harness our skillset to create any customization in and out of our system.

OPTIMIZE THE FLOW OF

LEAD AND WEB TRAFFIC

UNDERWRITING

Create and evaluate scorecards using 3rd party data to improve portfolio performance

PING TREE

Buy and sell leads, including organic traffic to your site, for greater revenue opportunities

SCORING

Score leads based on past performance using Machine Learning to increase key metrics

AFFILIATE MARKETPLACE

Meet more customers for selling (and buying!) traffic with seamless integration

TEKAMBI PRODUCTS

ORIGIN8

Lead Management of the decision engine provides flexibility to control your velocity at multiple levels. You can route leads using dynamic campaigns, keeping the questionable subID’s out and allowing the favorable ones in.

Complex underwriting is a cinch. Use our scorecard builder, and create alternative routing, and custom modeling all with the click of a button.

Tekambi’s industry-leading data vendor connectivity is second to none. Over 30 data vendors, including credit bureaus, are plugged in and ready to be activated with a flip of a switch.

AGORA PING TREE

Capture traffic from internal websites or from over 40 integrated lead providers and publishers

Lead Management

Sell organic traffic to other buyers

Lead Routing with pixel and click tracking

AFFILIATE MARKETPLACE

Tekambi’s Affiliate Marketplace will help connect lenders with lead providers, affiliates, and publishers in the small-dollar lending space and beyond. The benefit for affiliates to connect with more lenders to place their leads is obvious: the more direct lender connections, the higher the payout.

What is less glaring is that lenders are generating their own leads to a greater extent than ever before. Organic traffic to their website comes along with years of branding and dealing directly with consumers.

LOAN MANAGEMENT SYSTEM

INFINITY SOFTWARE

Infinity’s powerful all-in-one platform makes it easy to process loans, grow your customer base, and scale your business. Whether you are lending to 50 people or 50 million, feel confident that you have the easiest to use, most powerful technology, backed by the best support in the industry.

WHAT IS INFINITY?

A TRUE, ALL-IN-ONE LOAN MANAGEMENT SYSTEM, BUILT EXCLUSIVELY FOR ALTERNATIVE CREDIT LENDERS

EVERYTHING YOU NEED TO RUN YOUR LENDING BUSINESS

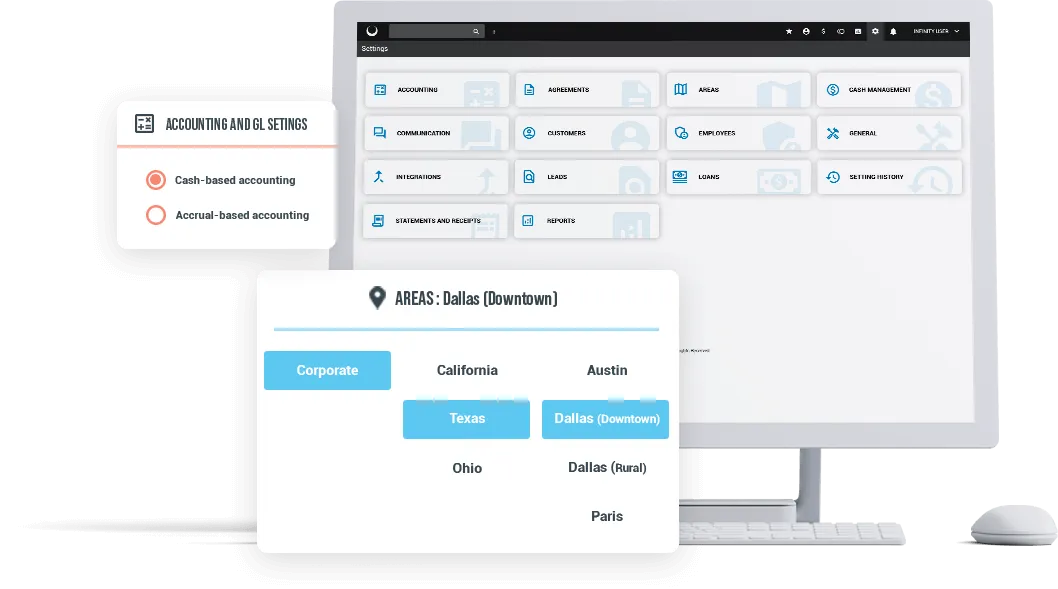

CREATE YOUR LOAN PRODUCTS

Easily set up your loan products and business rules for each product, area, state, city, or region that you lend in. Infinity is the only platform that gives you such granular control over what, where, and how you lend.

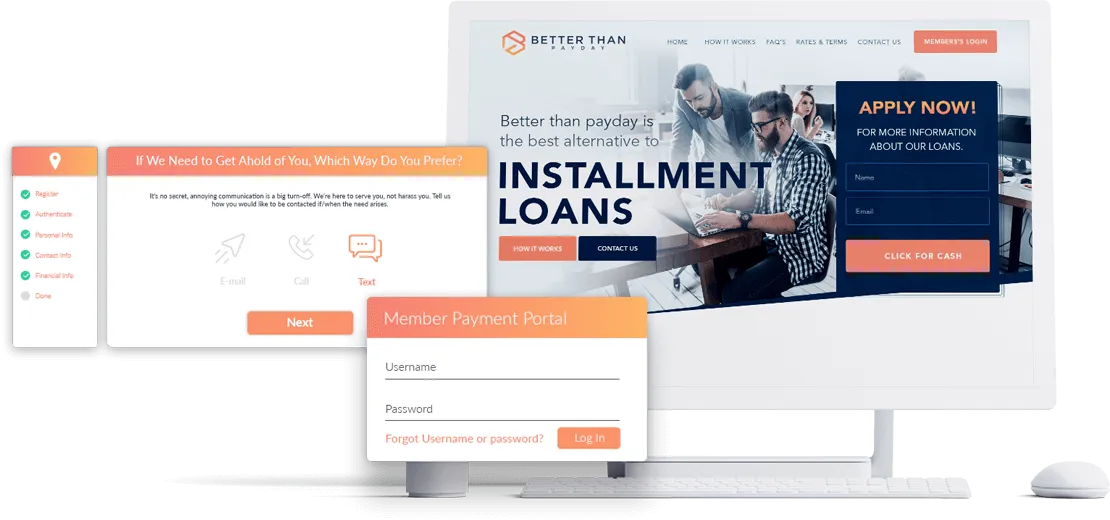

CONNECT WITH YOUR WEBSITE OR STOREFRONT

We connect our platform to your current site or build you a new one specifically designed to sell your loan products. If you lend in a store, you can use our cloud-based system right in your store with ease. Give your customers an experience they will love.

MARKET AND SELL

Get all the marketing tools, integrations, and payment processors you need to promote your business, lend more, and build relationships with raving fan customers who keep coming back for more. With our platform, you’ll join a community that has already earned over $7 billion from lending.

SUPPORT YOUR CUSTOMERS

When your customers thrive, so does your business. Use our robust suite of customer-focused features, including our simplified application process, beautiful customer account area, and all of the tracking and follow up tools you need to ensure that your customers are happy and successful.

COLLECT AND GROW

As your collection rates soar, so will your profitability and growth. Leverage Infinity’s built-in collection tools and integrations to improve collections. Set up collection tiers, build automated collections workflows, and create flexible payment plans to help your customers get back on track.

LOAN MANAGEMENT SYSTEM

EPIC LOAN SYSTEMS

EPIC has years of expertise in the small-dollar lending space. We help new and experienced lenders alike, offering powerful loan origination and servicing tools to monitor and analyze your portfolios. Consolidate your strategy without increasing overhead.

ONLINE LENDING

EPIC offers a variety of short-term, small-dollar consumer lending software solutions.

Installment Loans provide a full amortization option for short-term lenders, offering consumers equal payments for the life of the loan. EPIC supports tribal and state-model lending, including Texas CSO/CAB.

Installment Loans also allow you to explore multiple payment scenarios with the borrower before determining which one is most appropriate.

All critical loan lifecycle modules are included:

Lead Intake, Management, and Duplication Filter

Loan Underwriting

Loan Management

Payment Management (with ACH & Debit Card Integrations)

Customizable Marketing Engine (with Email & Text Communications)

Collections Management

EXTERNAL DECISION GATEWAY

EPIC gives you the ability to create your own internal rules as well as configure an underwriting waterfall. For most lenders, these internal system tools provide everything needed to control and manage the lead intake process.

However, some tech-savvy lenders are looking for an edge – and EPIC offers one! It’s called EDGe (External Decisioning Gateway), which provides a powerful and flexible method for integrating external decisioning into the native EPIC underwriting workflow.

Using EDGe you can pass data to an outside system, process that data, and return a response back to EPIC for inclusion in the underwriting decision-making process for a lead. If you’re a lender looking for this kind of EDGe, you’ve just found it with EPIC!

REPORTING & DATA ACCESS

Data is king. Data analysis is critical to making sound business decisions that keep your portfolio in the black. Companies that capture and analyze data, discover insights, and take action on those insights are better positioned to compete.

EPIC gives you a variety of options for gaining access and insight into your portfolio data:

Internal System Reports

Custom Reports

Data Extracts

Portfolio Management Reports

DART (Data Access in Real Time)

API

EPIC is an open platform that can be utilized through web services. For advanced lenders who want to interact with the system outside of the robust web interface, an API is available for you to build your own external applications that are tightly coupled with EPIC’s advanced feature set.

The EPIC API is a RESTful programming interface that allows you to access data directly from EPIC products. Designed with security and flexibility in mind, the goal is to permit Lenders to retrieve and modify portfolio data related to customers, loans, payments, configuration options, marketing operations, and many other system modules.

CONTACT INFO

Sales: +1 (954) 678-4600

Leadership@lendsuitesoftware.com

1200 SW 145th Ave

Suite 310

Pembroke Pines, FL. 33027

USA

Follow Us

©2026 LendSuite Software | An Aquila Software Portfolio | All Rights Reserved